Financial institutions use credit investigations to assess an individual’s creditworthiness. This involves reviewing their credit history, including payment records, outstanding debts, and past delinquencies. The goal is to determine if the applicant is a reliable borrower who will repay borrowed funds on time.

Lenders typically obtain credit reports from credit reporting agencies during these investigations. These reports offer a detailed credit history, aiding risk assessment. Factors like late payments, high debts, and bankruptcies can negatively affect an applicant’s creditworthiness and loan terms.

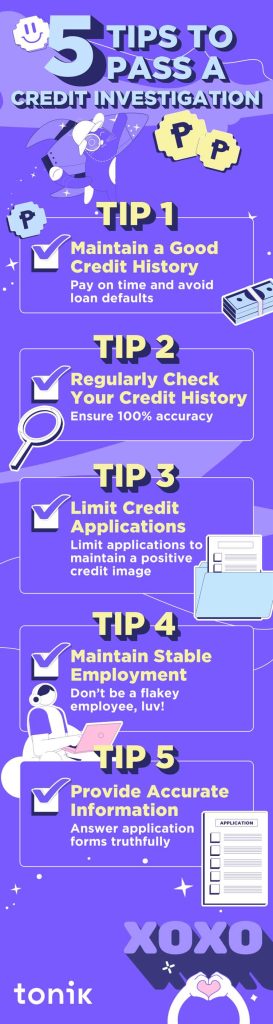

It’s crucial to note that a credit investigation leaves a “credit inquiry” trace on your credit report, visible to other lenders. Multiple inquiries in a short time may suggest financial difficulties and impact your credit score. To protect your credit score, it’s advisable to limit the number of credit inquiries you make.

Process of Credit Investigation

The process of credit investigation involves several steps to assess the creditworthiness of an individual or business. It plays a crucial role in determining whether a lender should approve or deny a loan or credit application.

1. Collecting Information: The first step in this process is gathering relevant information about the borrower. This may include personal information, income, employment history, and a list of assets and liabilities. The lender may also request permission to access the borrower’s credit report.

2. Analyzing Credit Report: The credit report provides a detailed history of the borrower’s past and current credit accounts, payment history, and any negative information such as delinquencies or bankruptcies. The lender carefully reviews this information to assess the borrower’s creditworthiness.

3. Verifying Information: After analyzing the credit report, the lender verifies the accuracy of the borrower’s information. This may involve contacting employers, financial institutions, or other references provided by the borrower. The goal is to confirm the borrower’s income, employment status, and overall financial stability.

4. Assessing Risk: Based on the information gathered and verified, the lender evaluates the level of risk involved in lending to the borrower. Factors such as credit score, debt-to-income ratio, and payment history are taken into consideration. The lender determines whether the borrower is likely to repay the loan as agreed.

5. Making a Decision: Finally, the lender makes a decision on whether to approve or deny the loan or credit application. If approved, the terms and conditions of the loan are established, including the amount, interest rate, repayment schedule, and any collateral requirements. If denied, the lender provides the borrower with an explanation and may offer suggestions for improving creditworthiness.

Data Collection

Data collection is vital for assessing an individual’s creditworthiness during a credit investigation. Various sources provide information, including credit bureaus, financial institutions, government agencies, and third-party providers. This data helps in making informed lending decisions and determining loan terms.

- Credit bureaus (e.g., Equifax, Experian, TransUnion) collect payment history, debts, and credit limits.

- Financial institutions share customer account details, payment histories, and defaults.

- Government agencies provide income, tax, and employment data.

- Third-party providers offer additional insights like employment, education, and social media activity.

| Data Sources | Types of Information |

| Credit Bureaus | Payment history, outstanding debts, credit limits |

| Financial Institutions | Account balances, payment histories, defaults, delinquencies |

| Government Agencies | Income, taxes paid, employment history |

| Third-Party Providers | Employment, education, social media activities |

Data Analysis

Data analysis is critical in credit investigation to gain insights and make informed decisions. Analysts assess factors like financial history, payment behavior, and credit utilization. Key aspects of data analysis include:

- Evaluating credit scores, which consider factors like open accounts, payment history, and credit utilization ratio.

- Reviewing credit reports for details on balances, payment history, and negative information like collections or bankruptcies.

- Identifying potential fraudulent activity through pattern analysis to protect lenders and consumers.

Verification and Validation

Verification and validation are essential steps in credit investigation to ensure the accuracy and reliability of borrower information.

- Verification confirms the authenticity of provided information, such as identity, employment history, and financial statements. Documents like pay stubs, bank statements, and tax returns may be requested.

- Validation assesses the credibility of financial data, including income, expenses, credit history, and debt-to-income ratio. This helps determine the borrower’s ability to repay the loan.

Both processes enable lenders to make informed lending decisions and manage risks effectively.

Types of Credit Investigation

When it comes to credit investigation, there are several types that financial institutions and lenders typically use to assess an individual’s creditworthiness. Understanding these different types can help you better understand how your credit is being evaluated.

1. Soft Inquiry: This type of credit investigation occurs when a financial institution or lender checks your credit report for informational purposes. Soft inquiries are typically initiated by you, such as when you check your own credit report or when a company pre-approves you for a credit offer. Soft inquiries do not impact your credit score.

2. Hard Inquiry: A hard inquiry happens when a financial institution or lender checks your credit report to make a lending decision. This type of inquiry is typically initiated by you when applying for a loan or credit card. Hard inquiries can have a temporary negative impact on your credit score, as multiple inquiries within a short period may suggest a high credit risk.

3. Employment Inquiry: Some employers may conduct a credit investigation as part of their hiring process. This type of inquiry provides information on an applicant’s financial responsibility and may be used to assess their suitability for certain positions. Employment inquiries are usually soft inquiries and do not impact credit scores.

4. Insurance Inquiry: Insurance companies may also perform credit inquiry when determining coverage rates or eligibility for certain policies. These inquiries help insurers assess the risk associated with a potential policyholder and may impact the premium or coverage options offered. Insurance inquiries are typically soft inquiries.

5. Tenant Screening Inquiry: Landlords or property management companies may perform credit investigations as part of the tenant screening process. This helps them evaluate an applicant’s ability to pay rent on time and responsibility as a tenant. Tenant screening inquiries are usually soft inquiries.

6. Collection Agency Inquiry: When attempting to collect a debt, collection agencies may conduct credit investigations to gather information about a debtor’s financial situation and determine the best course of action. These inquiries can be both soft or hard, depending on the purpose and authority granted to the collection agency.

Understanding the different types of credit investigation can help you navigate the credit landscape more effectively. It is important to be aware of when and why these inquiries may occur, as well as how they may impact your credit score.

Factors Considered in Credit Investigation

Lenders and financial institutions analyze various factors to determine the creditworthiness of an individual or business. These factors play a crucial role in the decision-making process, as they provide insights into an applicant’s financial stability and ability to repay the borrowed funds. Some of the key factors to consider:

- Payment History: Lenders review an applicant’s past payment history to assess their track record of repaying debts. They look for any late payments, missed payments, or defaults, as these may indicate a higher risk borrower.

- Credit Utilization: This factor takes into account the amount of credit a borrower currently uses compared to their available credit limits. A high credit utilization ratio may indicate that the borrower relies heavily on credit, which could impact their ability to handle additional debt.

- Length of Credit History: This factor evaluates the length of time a borrower has held credit accounts. A longer credit history provides more data points for lenders to assess the borrower’s creditworthiness and payment patterns.

- Recent credit inquiries: Lenders consider the number of recent credit inquiries made by an applicant, as multiple inquiries within a short period can be a signal of financial instability or an increased likelihood of defaulting on new credit.

- Debt-to-Income Ratio: This ratio compares an applicant’s total monthly debt payments to their monthly income. Lenders use this information to determine if the borrower has excessive debt compared to their income, which may impact their ability to make timely repayments.

- Public Records: Lenders also review public records such as bankruptcies, tax liens, and court judgments to assess the financial stability and legal standing of an applicant.

- Employment and Income: Financial institutions verify an applicant’s employment and income details to ensure they have a stable source of income to meet their financial obligations.

Credit History

Credit history records an individual’s or a company’s borrowing and repayment activities, offering insight into their creditworthiness and financial behavior. Lenders and financial institutions rely on credit history to assess lending risks.

- Includes data on past loans, credit cards, and credit accounts.

- Details borrowing amounts, terms, and payment history.

- Late payments, defaults, and bankruptcies are reflected.

- A good credit history secures better rates and terms.

- Lenders gauge repayment ability and predict credit behavior.

- Poor credit history may lead to higher rates and limited credit access.

- Building a positive credit history requires timely payments, low credit card balances, and responsible borrowing.

- Regularly checking credit reports, correcting inaccuracies is crucial for maintaining a healthy credit history.

Financial Stability

Financial stability plays a crucial role in credit investigation. Lenders and credit institutions look for signs of stability when assessing a borrower’s creditworthiness. Here are some key factors that contribute to financial stability:

- Steady Income: Having a consistent and reliable source of income shows that the borrower is capable of repaying the credit. Lenders prefer borrowers with a steady income as it reduces the risk of default.

- Low Debt-to-Income Ratio: A low debt-to-income ratio indicates that the borrower has manageable debt and enough income to cover the debt payments. This demonstrates responsible financial management and increases the chances of getting approved for credit.

- Consistent Savings: Having a savings account and regularly contributing to it shows financial discipline and the ability to handle unexpected expenses. It also provides a safety net during financial emergencies.

- Good Credit History: A positive credit history with timely payments, low credit utilization, and a mix of different types of credit accounts reflects responsible credit management. This builds trust in lenders and boosts the borrower’s creditworthiness.

- Long-Term Employment: Lenders consider stable employment history as an indication of financial stability. Borrowers with a long-term job and consistent income are viewed as less risky and more likely to repay their debts.

Benefits of Credit Investigation

Credit investigation refers to the process of evaluating an individual’s or a company’s creditworthiness. It plays a crucial role in financial decision-making and has several benefits.

| 1. Risk Assessment: Helps lenders and financial institutions assess the risk associated with extending credit to a particular borrower. By examining a borrower’s credit history, payment behavior, and outstanding debts, lenders can determine the likelihood of timely repayment and make informed lending decisions. | 2. Fraud Prevention: By conducting a credit investigation, lenders can detect potential signs of fraud or identity theft. Invoicing irregularities, mismatched identification details, or suspicious credit activities can be identified, allowing lenders to take appropriate action to prevent fraudulent transactions. |

| 3. Competitiveness: Helps companies maintain a competitive edge. By evaluating the creditworthiness of potential business partners or customers, companies can avoid working with entities that have poor credit histories or are at a higher risk of default. This ensures that businesses can choose reliable partners and minimize the risk of bad debts. | 4. Customer Screening: Through credit investigation, companies can screen potential customers before entering into business relationships. This helps businesses avoid payment issues and late payments, improving cash flow and reducing the risk of non-payment or default. |

| 5. Negotiating Power: Provides businesses with valuable information that can enhance their negotiating power. By knowing a customer or supplier’s creditworthiness, companies can negotiate better credit terms, such as longer payment periods or lower interest rates, which can positively impact their financial position. | 6. Better Financial Planning: By understanding the creditworthiness of customers and partners through credit investigation, businesses can make more accurate financial projections and plans. This helps in budgeting, determining cash flow, and setting realistic goals for growth and expansion. |

Overall, credit investigation plays a vital role in assessing risk, preventing fraud, maintaining competitiveness, improving customer screening, enhancing negotiation power, and enabling better financial planning. It provides valuable insights that help businesses make informed decisions and mitigate potential risks.

What is a credit investigation?

A credit inquiry is a process conducted by lenders or financial institutions to assess the creditworthiness of an individual or a business before granting a loan or providing credit. It involves examining the credit history, financial stability, and repayment capacity of the borrower.

Why do lenders conduct credit inquiry?

Lenders conduct credit investigations to minimize the risk of default and ensure that the borrowers have the ability to repay the loan. By assessing the creditworthiness of the borrower, lenders can make informed decisions about granting credit and determine the terms and conditions of the loan.

What information is included in a credit investigation?

A credit investigation typically includes information such as the borrower’s credit history, current and previous loans, payment patterns, outstanding debts, bankruptcies, and any legal actions taken against the borrower. It may also include income verification and employment history.

How long does a credit investigation take?

The duration of a credit inquiry can vary depending on various factors, such as the complexity of the borrower’s financial situation and the thoroughness of the investigation. It can take anywhere from a few days to several weeks to complete the process.

Can a credit investigation affect my credit score?

Yes, a credit investigation can have an impact on your credit score. When lenders request your credit report and conduct a credit investigation, it can result in a hard inquiry on your credit file, which may slightly lower your credit score. However, the impact is usually temporary, and responsible borrowing and timely repayments can help improve your credit score over time.

Why is a credit inquiry important?

A credit investigation is important because it allows lenders, banks, or financial institutions to determine the level of risk associated with lending money or extending credit to an individual or business. It helps them make informed decisions and minimize potential losses.

Leave a Reply